The Blockchain Trilemma: How Trade-offs Shape the TVL Landscape

As I was researching token economics and how blockchain projects might attract new investors, a question came to my mind

“Is there a relation between the blockchain trilemma and top blockchains by TVL (total value locked)?”. Yes, I believe there is.

The Total Value Locked (TVL) of a blockchain, the aggregated value of assets deposited in its decentralized applications (DApps) is the ultimate metric of ecosystem trust and utility. Indicating platform usage, user trust, and liquidity, reflecting real economic activity beyond just token speculation. TVL is the sum of all deposited assets (e.g., ETH, stablecoins, LP tokens) in a protocol, converted to USD at current market prices. A look at CoinGecko rankings of top blockchains by TVL reveals a clear correlation: market dominance is achieved through deliberate trade-offs in the Blockchain Trilemma: Decentralization, Security, and Scalability.

The Trilemma says that a blockchain can only maximise two of these three elements at the expense of the third. The top chains prove that the market is willing to reward different trade-offs based on the intended use case.

CoinGecko rankings of top blockchains by TVL (December,13, 2025).

The Dominator: Ethereum (Prioritizing Security & Decentralization)

Ethereum consistently commands the highest TVL, often holding over 50% of the market. This dominance is a direct result of its prioritization of Security and Decentralization at the base layer.

Security & Decentralization: Ethereum boasts a massive, globally dispersed validator set (well over one million active validators) and a battle-tested network, making it arguably the most secure and censorship-resistant settlement layer. This high level of trust is essential for high-value DeFi protocols, which explains its vast TVL.

The Trade-off: By maintaining strict decentralization and security standards, Ethereum's Layer 1 sacrifices native Scalability, resulting in slower transaction speeds and high gas fees during peak congestion.

The Solution: The market has accepted this trade-off by building Layer 2 networks (like Base, Plasma, Arbitrum and which feature prominently in the L2 TVL rankings) on top of Ethereum. These L2s inherit Ethereum's security while solving the scalability issue, allowing Ethereum to remain the ultimate source of trust while its ecosystem scales.

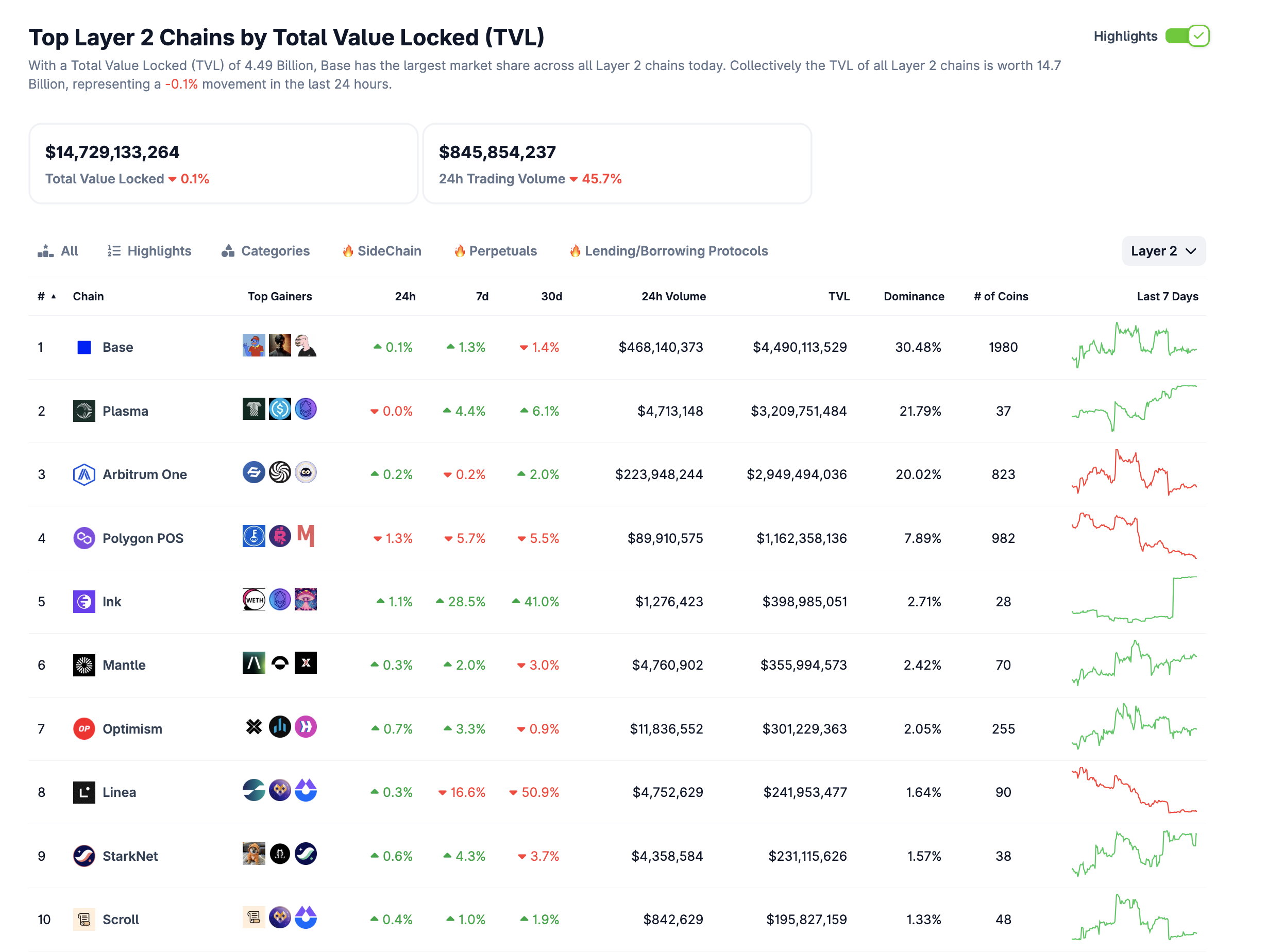

CoinGecko Rankings Top Layer 2 by TVL (December,14,2025).

The Challenger: Solana (Prioritizing Scalability)

Solana, a leading high-throughput competitor, has secured a significant TVL by taking a different corner of the Trilemma scalability and security.

Scalability & Performance: Solana is optimized for raw speed, low latency, and low transaction costs, offering a much higher theoretical Transactions Per Second (TPS) than Ethereum's L1. This focus makes it ideal for high-frequency applications like fast trading, gaming, and NFT markets.

The Trade-off: To achieve this high performance in a single monolithic chain, Solana requires substantially more powerful, and thus more expensive, hardware to run a validator node. This higher barrier to entry leads to a less decentralized validator set compared to Ethereum, which can raise centralization and network stability concerns (as evidenced by past outages).

The Result: Solana attracts TVL from users who value speed and cost-efficiency above maximal decentralization, showing a market segment willing to make that specific trade-off for performance.

The Hybrid: BNB Smart Chain (Prioritizing Scalability & EVM-Compatibility)

BNB Smart Chain (BSC) generally ranks highly by TVL due to its early adoption and high transaction throughput.

Scalability & Utility: BSC achieves high transaction speed and low cost by utilizing a Proof of Staked Authority (PoSA) consensus mechanism with a very limited validator set (historically 21 or slightly more).9 It also benefits from EVM-compatibility, allowing for easy migration of Ethereum applications.

The Trade-off: The limited validator set, while boosting Scalability, significantly reduces Decentralization, introducing a higher degree of centralized control and potential censorship risk compared to Ethereum.

The Result: Its high TVL indicates a large user base that prioritizes cheap, fast, and familiar Ethereum-like infrastructure, accepting a lesser degree of decentralization.

The Takeaway

The top of the TVL leaderboard is a constant reflection of the Trilemma. Blockchains that succeed are not those that "solve" the Trilemma, but those that optimize the trade-offs to perfectly align with the needs of a large, high-value user base. Ethereum holds the crown by being the most trusted settlement layer, while chains like Solana and BNB Smart Chain demonstrate that the market will reward speed and low fees, even if it comes at the cost of maximal decentralization.