DeFi Platforms Comparison

One of the most successful types of decentralized apps are Decentralized Finance (DeFi) platforms. A DeFi platform acts as a marketplace that connects users who need financial products, such as loans or token exchanges, with users who can provide liquidity. In traditional finance, the providers of finance products are banks and financial institutions.

DeFi is an extension to Bitcoin’s vision of finance without banks. In short, anyone can access/provide financial services without KYC or credit check. From short-term or long-term lending, staking, and more. The interest rate is determined by an algorithm that adjusts according to the supply and demand of the pool.

I’m comparing three DeFi platforms: Uniswap, Aave, and Pancake Swap. I selected these three because they are the most well-known. Also, Uniswap and Pancake Swap are always topping the DeFi charts in terms of marketshare and trading volume.

There are many aspectss to compare, I’ll be focusing on core features and product perspective. Hopefully, I’ll do a better job than A.I.

User Experience

Guest Access

A guest access mode allows visitors to try the basic features of an app or a platform without creating an account or logging in. As a result, users experience less or limited friction to experience the value of a product.

Uniswap and Pancake Swap immediately present the swap box to the user. The swap box is the currency exchange interface that allows the user to select the coins they want to exchange.

At the time of testing, Uniswap consistently updated the value of the selected coin in near real-time. Pancake Swap was also updating the value, though it appears Pancake Swap’s update interval is slightly slower than Uniswap. Unfortunately, Aave, didn’t have a guest mode at all. Instead, it requires a wallet to be connected before even viewing different coin exchange rates.

DeFi apps guest access comparison

Wallet Connectivity

Anything in Web3 is accessible via a wallet. Think of it as a Gmail or Apple ID account. Wallet connectivity is set up by a DeFi app.

To connect a crypto-wallet, the user goes through a series of steps:

Clicks on the “Connect wallet” button visible on the main DeFi webpage.

View the options available depending on the DeFi platform experience. Such as

Log in to the wallet via a web-browser extension.

Log in to the wallet by scanning the QR code with their mobile phone.

Create a new crypto wallet (Some DeFi platforms have their wallets).

Consents the DeFi platform to connect to the user’s wallet (including the wallet’s history).

Refresh the page, click on “Switch tokens”, and then select the tokens that will be exchanged.

Meta Mask Mobile App

Users can select which account to connect as well as the networks that the DeFi platform can access. The actual networks can first be set within the wallet

Wallet Integration

All of the platforms support different wallets like MetaMask, Trust Wallet, or Coinbase Wallet.

However with Uniswap, it was odd. Initially Metamask wasn’t listed I had to reload my MetaMask browser extension to make it visible to Uniswap connect wallet options. While Pancake Swap and Aave offered MetaMask and many others from the first time.

I suspect Uniswap wants to acquire more users so this might be intentional.

Wallet Support Comparison

Swapping and Liquidity Pools

In DeFi, swapping is the act of exchanging tokens using liquidity pools. The value of a token is determined by the supply and the demand in a liquidity pool. DeFi platforms use and connect to more than one liquidity pool to accommodate the amount the user wants to exchange.

Generally speaking, when a DeFi platform offers different liquidity versions, it is basically an update on the number of assets that can be swapped, the available amount liquidity, and a couple of functionalities.

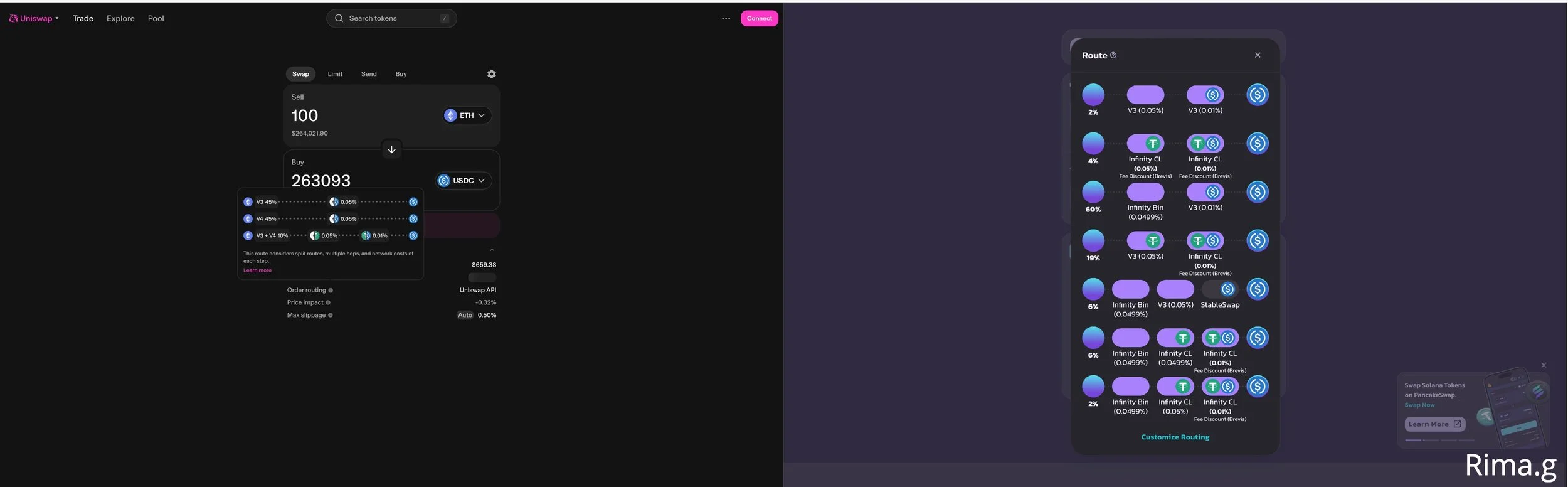

Uniswap automatically uses the best liquidity pool options according to price, liquidity, and network costs. However, users can also select which liquidity pools to use.

Pancake Swap is similar to Uniswap, but it allows for more routing customization, such as direct swapping or swapping across multiple pools. It depends on the user’s preference.

Swap Routing Across Liquidity Pools

Aave is different than the other two, as it doesn’t offer any liquidity pool selection. There’s only one default option Avave’s liquidity pool.

DeFi Swaps Liquidity Pools Comparison

Code Transparency and Security

When it comes to open source, Uniswap’s code for all three of its applications (website, mobile app, and web extension) is available on GitHub. Pancake swap code is also open-source. Aave Labs is no different.

Uniswap states that its wallet has been audited by Trail of Bits. However, there’s no mention of auditing Uniswap’s website or web extension. Uniswap also has a bounty process on Bug Bounty.

Pancake Swap’s audit is done by several entities on different aspects, such as smart contracts and code.

Aaave has also been audited by many entities, as well as offering a bug bounty.

All three of the Dapps have published the results of the audits for anyone to view. Which is amazing, if someone wants to learn or verify the security of any of the DeFi platforms.

I don’t have the experience to actualy asses which DeFi platform is most secure. Therefore, I’ve reviewed Certik’s Skynet blockchain and DeFi security ranking website. As of May 2, 2025, Uniswap is the safest among the three, with a score of 95.18/100. In comparison, Pancake Swap’s score is 91.92/100. Aave’s is 90.13/100.

As of May,2,2025, Uniswap has the highest rank in security among the three DeFi platform.

Fees

Uniswap and Pancake fees breakdown are strightfroward and explained one cost at time. Except for Aave, it only shows one accumlative cost.

Pancake swap has a unique item “Fees Saved” where it showes the user how much the user is saving when using Pancake Swap compared to other DeFi platform. I can’t confirm what are the platfrom this service is comparing or if this is accurate or not. But it is cool and encougres the user to take action (fear of missing out).

DeFi Swapping Fees Comparison

Pancake Swap Sound Effect

Fun Sounds by Pancake Swap

I got excited to try this fun feature on my desktop. Unfortunately, I didn’t hear anything at all. I’m not sure when it is supposed to be triggered. Let me know in the comments if it worked for you.

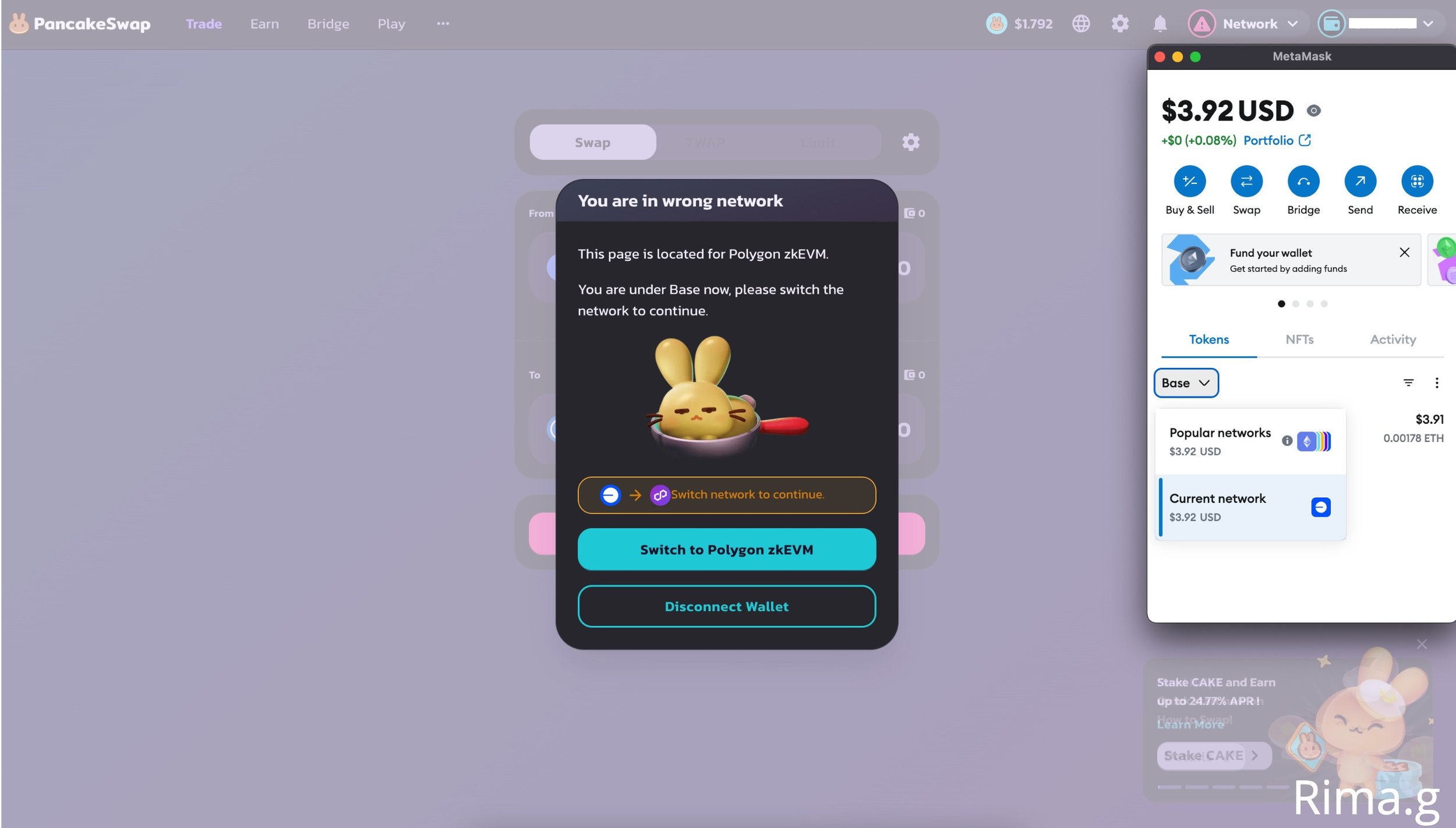

2. Incorrect Network Warning Message

Usability “Auto-Correct” for Human Error

Another consideration by the team at Pancake Swap. When I selected a token that was on a different blockchain than my wallet, I got this message from Pancake Swap to help me understand my mistake, while providing a solution, “switch to Polygon”.

3.Bitcoin Purchase at Ethereum address Warning Message

Warn User Before Making a Fatal Mistake: Sending Native BTC to an Ethereum wallet address

A common mistake by new crypto users is to buy native BTC with an Ethereum wallet address. When this happens, the funds are lost, since the Ethereum address can’t store BTC. It can’t be recovered. There are workarounds to do this, with wrapped tokens. Read more about it here.

I find this tip the most helpful without being too intrusive,

Final Thoughts

There are many aspects I haven’t covered, but I wanted to bring a well-rounded comparison. Let me know your thoughts in the comments.

Stay vigilant!